作者简介:王 敏(1979-),女,湖北省仙桃市交通投资有限责任公司中级会计师,总会计师,研究方向为交通建设筹融资、企业财务管理; 刘晓岚(1975-),女,中国冶金科工集团公司副教授,高级经济师,工学博士,研究方向为法学理论、中央企业法律实践管理、纪检监察管理、财务管理。E-mail:11104071@qq.com

(1.湖北省仙桃市交通投资有限责任公司,湖北 仙桃 433000; 2.中国冶金科工集团有限公司,北京 100028; 3.中国中铁置业集团有限公司,北京 100055)

(1.Hubei Xiantao Transportation Investment Co., LLC, Hubei Xiantao 433000, China; 2.the Metallurgical Cooperation of China, Ltd, Beijing 100028, China; 3.China Railway Real Estate Group Co., Ltd, Beijing 100055, China)

the bank claims; earnings quality; the earnings frequency histogram

DOI: 10.15986/j.1008-7192.2018.05.006

备注

作者简介:王 敏(1979-),女,湖北省仙桃市交通投资有限责任公司中级会计师,总会计师,研究方向为交通建设筹融资、企业财务管理; 刘晓岚(1975-),女,中国冶金科工集团公司副教授,高级经济师,工学博士,研究方向为法学理论、中央企业法律实践管理、纪检监察管理、财务管理。E-mail:11104071@qq.com

银行债权保障是上市公司盈余质量提高的内在驱动力之一,公司盈余质量提高又反过来强化银行债权保障。两者互为因果,相辅相成。两者的良性互动需要对盈余管理内涵,对上市公司盈余管理的动因进行结构化分析,即盈余管理的动力、契机、空间和可能性均一定程度存在,由此根据上市公司报表数据建立盈余频率分布模型,通过对盈余频率直方图分析得出盈余管理普遍存在的现实结论。进而从健全关联交易法律制度、完善公司治理结构、完善现有融资结构、完善内控机制等方面探讨银行债权保障与上市公司盈余质量提高的对策。

The protection of the bank claims, one of the intrinsic driving forces for the improvement of the quality of listed companies' earnings, is reinforced in return by the latter, for both interact as reciprocal causation and complement each other. To achieve the benign interaction between the two, the paper studies the connotation and the motivation of earnings management of the listed companies by using the structural analysis. It is found that there exist a certain degree of the motivation, the opportunity, the space, and the possibility in earnings management. Based on the report data of the listed companies and an earning frequency distribution model established, the paper analyzes the earnings frequency histograms and draws the conclusion about the general issues existing in the earnings management. Furthermore, it discusses the protection of the bank claims and the countermeasures to improve the quality of the listed company earnings.

引言

目前我国上市公司依然没有打破以中介贷款融资为主、市场证券融资为辅的融资格局。尤其是上市公司的债务融资过度依赖于银行,资金融资难度较大,上市公司出于取得贷款的动机,往往会对企业的会计信息进行盈余管理; 现有银行债权保护措施的不力,导致了大量银行不良债权的产生。这对上市公司盈余质量的提高以及银行债权的实现都是极为不利的。

银行债权保障与上市公司盈余质量提高两者之间互为因果,相互促进。银行债权保障客观上需要消除呆账、坏账,提升债权质量,上市公司主观上存在业绩提升、资金信贷的经营考核因素驱动,因而在盈余管理上形成某种程度的共识。随着盈余管理质量提升要求的不断加大,上市公司盈余管理的动因、规模、质量越来越与银行债权保障紧密联系,并发挥积极作用。

1 上市公司进行盈余管理的动因分析

盈余管理,是会计政策的选择具有经济后果的一种具体表现。当管理者在编制财务报告和构建经济交易时,运用判断改变财务报告,从而误导一些利益相关者对公司根本经济收益的理解,或者影响根据报告中会计数据形成的契约结果[1]。

产生盈余管理的根本原因是企业管理者与利益相关者(包括股东、债权人、职工、客户等)之间利益的不一致。两者追求的目标是有差异的,行为的动机或激励手段也不统一。加上信息的不对称、委托代理契约的不完全与利益主体的利己性,使得企业管理者有动机也有可能为了自身的利益而进行盈余管理。另外,从会计角度看,盈余管理的存在与我们现行会计所采用的原则与方法是分不开的。

我国的资本市场相对不完善,发行债券的企业相对较少,所以企业的债权人多数是银行或者是其他金融机构。我国现行上市公司普遍采用所有权与经营权分离的模式,这时候便产生了委托代理关系。在委托代理关系中,委托人与被委托人存在利益点不一致的问题,而银行作为资金的所有者,其将货币资金贷给企业,便与企业形成了一种委托代理关系。上市公司为了吸引潜在投资者、债权人,树立既有投资者、债权人的信心,需要向外传递一个经营业绩好的信号。企业进行盈余管理的动机有很多,在此,主要针对企业与债权人——银行之间的影响因素进行分析。

1.1 获得银行贷款是上市公司进行盈余管理的动力上市公司要想获得银行的贷款,必须通过银行的信贷评估。作为银行来说,要对上市公司进行信贷评估,需要对评估企业的会计信息进行收集、整理和分析,这无疑要花费银行大量的人力、物力和财力。银行作为自负盈亏的市场主体,当监督成本过高时,便会采取简单的“零盈余”方法来决定是否对企业进行信贷支持以及企业进行担保的强度。如果企业的盈余为负值时,银行会认为企业缺乏足够的偿债能力,从而影响对其贷款的政策。企业逐渐意识到银行信贷评估在其贷款政策中的重要性时,便会对自己的会计信息进行粉饰,调高利润避免亏损,从而希望能顺利取得银行的贷款。

1.2 银行监督不到位为盈余管理提供了空间银行是以盈利为目的,承担信用中介的金融机构。随着市场经济的不断完善与发展,银行已经逐渐变成自主经营、自负盈亏的经济主体,已经慢慢被纳入了市场经济体系中,国有银行一统天下的格局被打破后,越来越多的商业银行参与到激烈市场竞争中来。由于商业银行经营商品——货币具有同质性,而银行在建设的过程当中固定成本相对较高,可变成本相对较低。此时,银行提供的产品和服务增加可以显著的降低成本,增加收益,从而提高银行在整个行业中的竞争力。

银行对其信贷决策以及债权保障条款的一个重要考量就是借款企业的经营业绩以及未来产生的现金流,银行对公司利润的关注使得借款企业有动机为了获得贷款以及更优惠的借贷条款去粉饰公司业绩。借贷市场的信息不对称,使得借款企业存在着逆向选择。银行意识到借款企业的违约风险,因而对于经评估认为存在信用风险的企业,银行会要求担保。而一般认为,银行比普通的债权人拥有更专业的知识,能够更好地获取和处理信息,以及具有更好的再谈判弹性,银行能够识别企业的盈余管理行为[2]。而公司的盈余管理行为,使得银行对公司未来现金流的估计会产生不确定性,由此形成了银行的信息风险。因此,如果银行意识到公司的盈余管理行为,则公司盈余管理程度越大,借款需要担保的概率越高。

实务中国内银行贷款审批上,审批权往往在总行,实际对借款企业的考察和评级则由具体的支行或分行执行,这样的信贷流程造成了严重的信息不对称,可能造成总行无法识别企业的盈余管理行为。同时,专业和成本的限制使得银行信贷人员无法独立核实公司财务状况和经营成果的真实性和公允性,他们对企业财务状况的分析往往依据已审的公司财务报告。而弱法律环境下的中国审计市场的审计质量低下,上市公司存在广泛的盈余管理行为空间。

1.3 社会信用体系不健全为盈余管理提供了契机为了限制企业牺牲银行利益以实现自身目的的自利行为,银行会与企业签订债务契约。银行希望能取得利息收益的同时尽可能大的保障资金的安全,而作为企业来说,则希望资金能够带来巨大的收益,在对资金的使用过程中会较少关注资金的安全。银行为了保护自身债权的顺利实现会在契约中规定很多限制条件,企业如果违约会付出巨大的代价。然而,我国的信用体系尚不健全,缺乏相应的约束机制,企业信用意识淡薄,逃离废债的社会成本不高。上市公司为了实现企业或者是自身的利益,会将资金挪作他用,无视债务契约的既定要求,当经营出现亏损时,又会恶意逃离银行债务。

1.4 我国现行的会计政策为盈余管理提供了可能在我国,会计政策包括会计准则或会计制度规定,在准则或制度允许的范围内选择适合企业实际情况的会计政策,并在会计报表附注中予以披露。但是传统会计收益理论在会计确认上的滞后、会计计量上的缺陷及会计原则的固守,为上市公司进行盈余管理提供了可能。在现行的会计模式下,企业的盈余主要分为现金流和应计利润两个部分。现金流主要是以收付实现制为基础的,所以其可操纵性较小。而应计利润部分则主要以权责发生制为基础,这就为企业的管理当局进行盈余管理提供了契机。管理当局出于自身或者是企业的需要,会对企业发生但还没有实现的费用或者是收益提前或延期计量,严重影响了会计盈余的真实性和公允性。

2 上市公司盈余频率分布模型分析

2.1 理论分析盈余频率分布模型是检验盈余管理是否存在的模型,可以不考虑可操纵性和不可操纵性利润,而是根据盈余管理后盈余的分布特点来检验企业是否进行了盈余管理。在盈余频率分布模型中,如果上市公司没有进行盈余管理,则其实际盈余应服从正态分布; 如果上市公司为了取得银行的贷款而进行了盈余管理,那么盈余在阈值处的左右两边会急剧增加或减少,离正态分布趋势。此时,判断上市公司是否进行了盈余管理,只要看其在阈值处盈余分布曲线是否光滑即可。

2.2 研究假设假设1:上市公司没有进行盈余管理时,企业盈余管理服从正态分布,盈余频率分布曲线是平稳、光滑的,这些点均匀、对称的分布在阈值两边。

假设2:上市公司进行盈余管理时,盈余频率分布曲线是不光滑或不连续的,且盈余管理的程度越大,则阈值两边的点的偏离程度越大。

假设3:上市公司进行盈余管理时,低于阈值处的频数分布会不寻常的少,高于阈值处的频数会不寻常的多,造成阈值两侧样本频数有显著差异。

假设4:当企业为了避免亏损而进行盈余管理,会在阈值点0处进行盈余管理,我们选择阈值为0。

2.3 样本选取为了研究上市公司为了取得银行贷款是否具有盈余管理现象以及盈余管理的程度如何,我们采用每股盈余进行研究。在盈余频率分布研究中,选取了2016、2015、2014年上市公司年报中公布的上市公司每股盈余为研究指标。因为金融保险行业本身具有特殊性,所以我们剔除了金融保险行业的相关数据,并且剔除了被特别处理(ST)和特别转让(PT)的公司样本。行业分布相当广泛,有工业(包括机械制造业、纺织业,食品业,电子,服装,玻璃,化工),建筑业,批发零售业,交通运输和邮政业。使样本数据更具有客观性、代表性。最后我们得到的观察值为2016年403个、2015年429个、2014年396个。

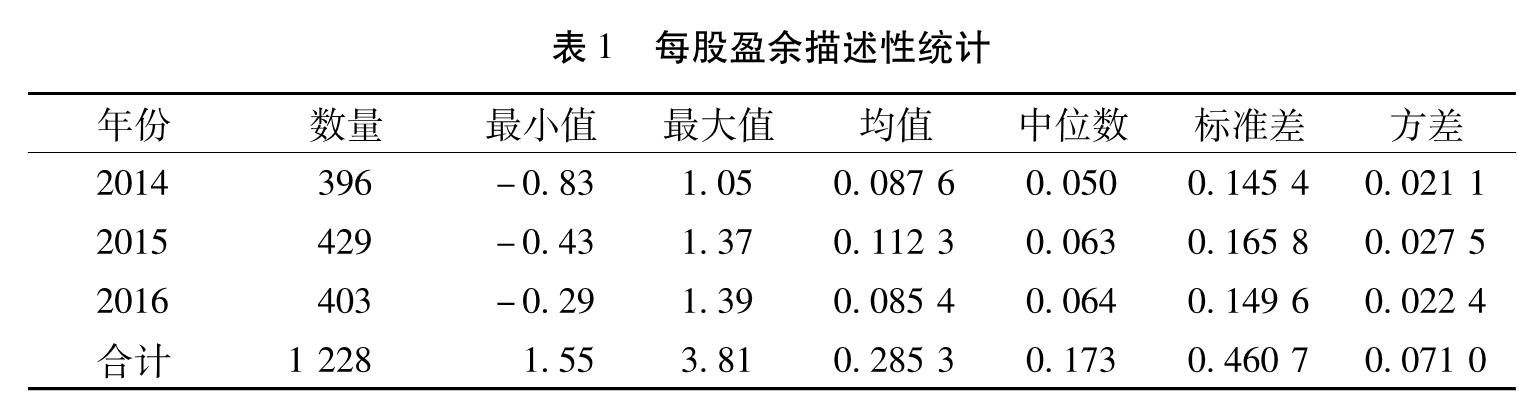

从表1可以看出,全部样本的最大值为1.39,范围从1.05至1.39,中位数为0.173。2014年的每股盈余平均值为0.087 6,范围从-0.83至1.05,中位数为0.05; 2015年的每股盈余平均值为0.112 3,范围从-0.43至1.37,中位数为0.063; 2016年每股盈余平均值为0.085 4,范围从-0.29至1.39,中位数为0.064。可见,上市公司的每股盈余呈逐渐上升之势。

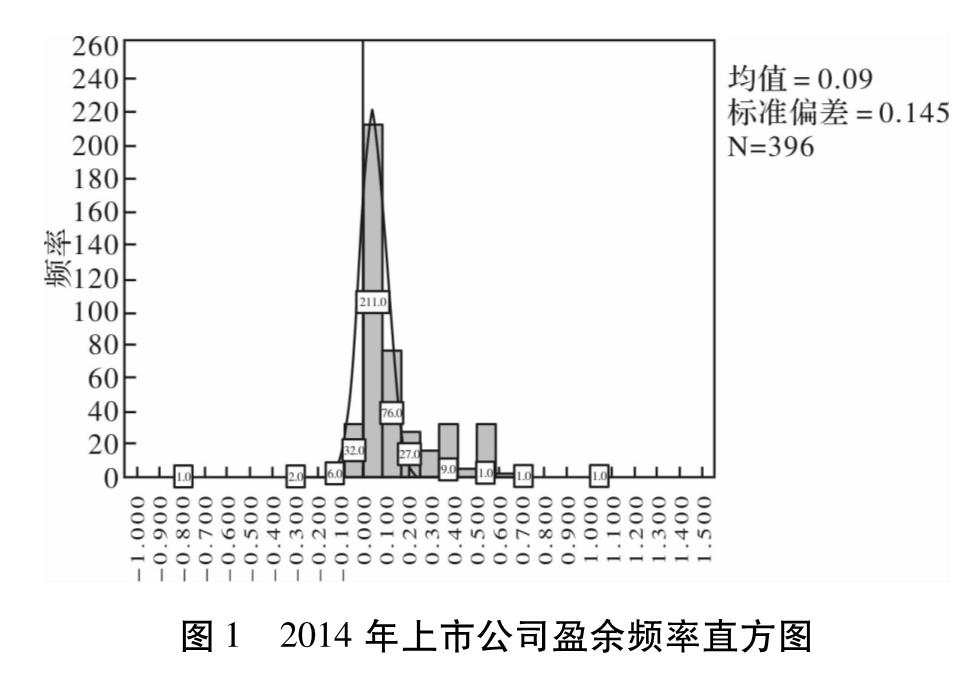

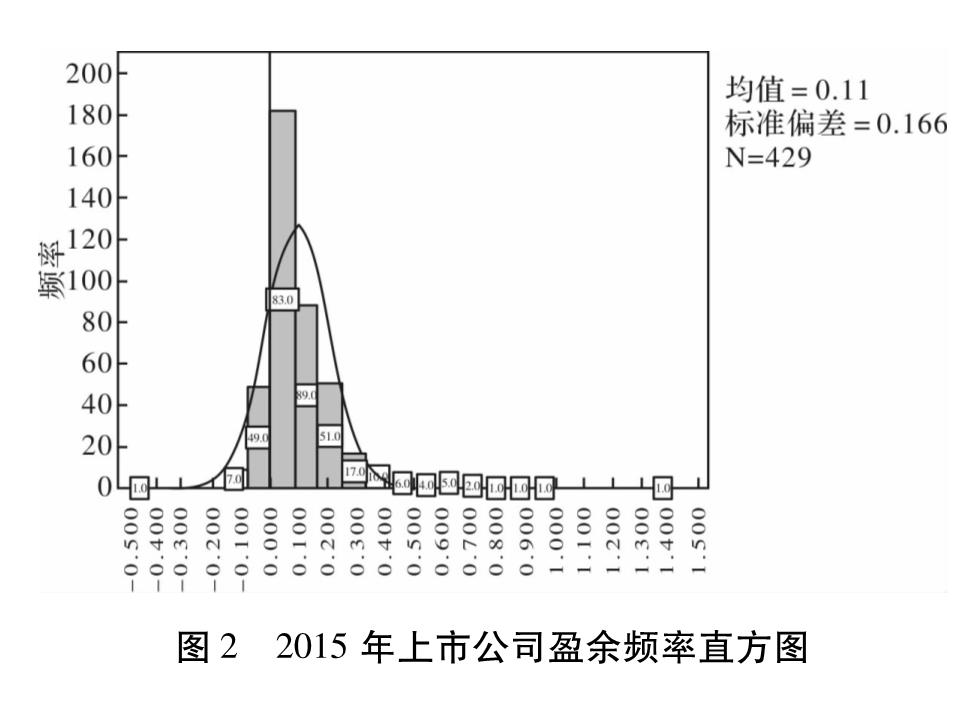

2.4 模型分析根据中心极限定理,上市公司的每股盈余分布应该近似的服从正态分布。我们根据上市公司年报所提供的上市公司的每股盈余数绘制频率直方图。其中,X轴代表每股盈余,Y轴代表公司频数,组距为20。 图1~图3是对上市公司2014、2015、2016年每股盈余频率直方图的分布情况的分析。

从三年的每股盈余频率直方图中可以直观地看出,在微利区间0处形成了一个显著的巨峰,说明存在非随机因素影响每股盈余的分布,这可能是由中小企业管理当局适度盈余管理造成的。根据图1可以发现,在阂值0处报告每股盈余的分布具有明显的跳跃现象,即样本比例在阂值0的左边突然减少,而在阈值0的右边则突然增多,每股盈余在阈值0的右边区间[0,0.100]处显著增多,所占频数总计211,约占该年上市公司总数的53.3%左右,这就是上市公司进行盈余的表现之一。根据图2可以看出,在微利区间(0,0.100]处形成了一个显著高峰,所占频数为183,占总数的比例为42.7%。而在图3中,数据的跳跃性较上两年而言相对集中,在(0,0.100]中也是形成了一个显著份额微利高峰,结合对中位数的分析发现,中位数也恰好分布于每年的微利区间中。在盈余频率直方图中,在阈值0点的左边,正态分布曲线所形成的曲线与条柱所围成的空白部分,即为盈余管理公司真实盈余的分布; 而在阈值O点的右边,条柱超过实线的部分,就是盈余管理公司在管理盈余之后的报告每股盈余的分布。通过对近三年上市公司每股盈余的频率直方图分析可以看出,上市公司为了取得银行贷款,普遍存在盈余管理行为,当公司发现自己的每股盈余接近阈值0这个临界点时,上市公司为了获得银行的贷款,达到银行的信用等级要求,可能会调整会计计量方法或采取其他一些盈余管理行为使小额亏损变为小额盈利。

3 政策建议

3.1 健全关联交易法律制度,构建银企新型的长期合作关系健全关联交易法律制度,将压缩盈余管理生存空间。关联交易作为盈余管理最常用的手段值得多方特别关注。关联交易这一区域的监管缺失很大程度纵容了盈余管理。应该不断完善关联交易披露要求,改善资本监管规则,减少企业为美化财务报告而进行的盈余管理行为[3]。

在健全关联交易制度安排的情况下,不管上市公司是否进行盈余管理,企业信贷人员总是要定期不定期的对其账务进行监督。可以要求企业的主要支付结算业务通过贷款银行来进行,做到账务透明,对于银行来说,可以降低自身的监督成本,取得更好的监督效益。对于企业来说,和银行建立长期合作关系,可以从银行获得更有利的贷款优惠额度,可以减少盈余管理的动机,从而提高企业的盈余质量,形成良性互动和长期合作。

3.2 鼓励企业建立长期信誉机制,实现银行之间信息共享鼓励企业建立长期信誉机制,在与银行的合作中,按时还贷,按要求使用,长期如此,可以在银行的信贷评估中建立良好的信誉。对于信誉良好的企业,可以通过授牌、颁发信用等级证书等仪式提高企业的知名度,并且可以利用媒体等方式对信誉较好的企业做出表彰,实现银行之间的信息共享,并给予信贷上的优惠政策,使企业从被动受评逐步转变为自觉要求,从而降低企业的盈余管理程度; 对于银行来说,银行之间的资源共享更是可以提高对上市公司的监督效率。

3.3 提高企业盈利能力,完善公司治理结构完善公司治理结构。股东大会对企业经营权的丧失一定程度上催生了管理层以自身利益为目的的盈余管理。合理高效的公司治理结构能够促进股东对管理层的监管,削弱管理层的权利。这需要对股权结构进行优化、在独立董事中加重财务董事的比例等措施。企业要意识到,对会计信息的粉饰只可能在短期上取得银行的贷款,长此下去,对其信誉是严重的损害,必然不利于企业的长期发展。盈利能力的持续上升是企业的生存之本,盈利能力提高了,偿债能力也可能获得提升。企业在自己的生产经营过程中,不仅要重视生产经营能力的持续上升,更是要信誉与经营并重。偿债能力的提升,信誉的保证,对银行债权的实现而言也是一种双重保障[4]。

3.4 不断完善现有融资结构,降低盈余管理动机我国上市公司多由国有企业改制而来,自身积累和盈利能力较差,决定了其将融资的目光过度投向外部环境。但是我国的资本市场还很不完善,融资渠道不畅通,融资方式单一。这就要求我们对金融工具进行创新,实现金融工具的多元化,为上市公司提供多种融资途径的选择,而银行是金融市场的主体,要不断完善融资结构必然要依靠银行强有力的支持。融资渠道的畅通,会为上市公司提供更多的选择,其盈余管理动机必然也会降低[5]113-116。

3.5 不断完善内部控制制度,提高上市公司和银行从业人员素质完善会计准则和建设会计制度。盈余管理是企业管理层根据自身需要在会计准则规范内做出的最优选择。当前的经济发展水平下,现行的会计准则和制度已经运行的有些吃力。经济发展势必会带出新的问题,可见会计准则和制度的编写工作任重而道远,需要持续不断的完善和建设,减少模糊的定义,尽量减少可以选择的会计政策和方法,完善体系,才能压缩盈余管理的空间,才能与经济发展相匹配。

现代企业银行信贷人员实行计件制,其工作业绩往往与存贷业务有直接的关系,可能导致工作人员降低审核标准,这就要求银行要不断完善内部激励机制,将贷款质量作为考核的标准之一,不断提高银行信贷人员的业务素质和思想素质。对于企业而言,应该将主要精力放在自身的经营发展上,公司的会计人员,要不断坚守自身的职业道德,职业操守,坚持自身的独立性,保证会计信息的真实完整。完善注册会计师审计制度。提高对注册会计师审计职能的要求以及对审计工作的质量要求,并加大外部审计的法律风险和违规风险。审计时需要对异常损益项目刨根问底。

综上所述,探索银行债权保障与上市公司盈余质量提高的平衡之道,重点还在于健全关联交易法律制度,从制度层面整合信息共享机制、完善法人治理结构、规范内控管理体系,进而实现融资结构的优化调整,实现两者的良性互动和共同发展。

- [1] 杨洁,李慧琳.基于债务重组的上市公司盈余管理实证研究[J].河北工业科技,2018(1):8-9.

- [2] 陆阳. 我国上市公司盈余管理问题研究[J]. 经济研究导刊, 2016(27):64-65.

- [3] 罗焰, 李玉洁. 上市公司盈余管理的动机与治理[J]. 商业时代, 2016(19):183-184.

- [4] 陈楠. 内部控制信息披露对盈余管理影响研究[J]. 财政监督, 2016(10):94-97.

- [5] TIAN F, QIN Y, ZHANG J. Motivation research of earning management in chinese listed companies with controlling rights transferred[C]//International Seminar on Business and Information Management. IEEE, 2008.